Before you invest in business coaching, it’s a good idea to check whether you can deduct coaching expenses from your taxable income. The quick answer: yes, you normally can. Keep reading to find out when coaching is deductible in Australia and how you can record a deductible expense in your bookkeeping software.

How Business Tax Deductions Work in Australia

If you operate a business in Australia, you can deduct business-related expenses from your taxable income. For example, if you earned $100,000 from your business and had $10,000 in business-related expenses, you would only pay tax on the remaining $90,000. Keep in mind that any deductions must be directly related to earning taxable income.

For example, you can’t claim things like a family holiday as a deduction, even if you paid for it through your business. You also can’t claim mixed business and personal expenses as business-only expenses. If you purchased a laptop that you used half the time for work and half the time to watch Netflix, you could only claim 50% of the laptop’s cost as a tax deduction.

Is Business Coaching Tax-deductible?

Business coaching is normally considered a tax-deductible expense in Australia. Why? Because business coaching does contribute directly to earning more income. The things that coaches teach – how to enhance your marketing, how to implement systems, how to drive profit – are all designed to improve your bottom line.

Keep in mind that business coaching is not the same thing as executive coaching or life coaching. Business coaches work with business owners and executive teams to improve one or more aspects of a business – they’re business success practitioners, with a clear focus on commercial outcomes.

While executive coaching and life coaching can benefit business outcomes, they’re focused on improving individuals. For example, ‘self-improvement’ coaching would typically be too generalised to be written off as a tax deduction. If specific courses or sessions do have a direct link to income-producing activities, you may be able to claim them as partial deductions.

The ATO clearly describes its position on general self-education in TR 98/9, stating:

“If a course of study is too general in terms of the taxpayer's current income-earning activities, the necessary connection between the self-education expense and the income-earning activity does not exist. The cost of self-improvement or personal development courses is generally not allowable, although a deduction may be allowed in certain circumstances.”

Because different business coaches may have different approaches, don’t assume that all business coaching is tax-deductible. Before you put down your coaching costs as deductible expenses, check with your accountant.

So Is Business Coaching Tax-Deductible?

Yes, business coaching is normally tax-deductible in Australia. Life coaching is not normally tax-deductible. Executive coaching may be deductible if it contributes directly to income.

Always check with your accountant before making any write-offs.

How to Claim Business Coaching in Xero

As a small business owner, you probably use bookkeeping software like Xero, QuickBooks or MYOB to keep track of your income and expenses. Xero is one of the most popular options in Australia, so we’ll walk you through how you can use it to write off business coaching.

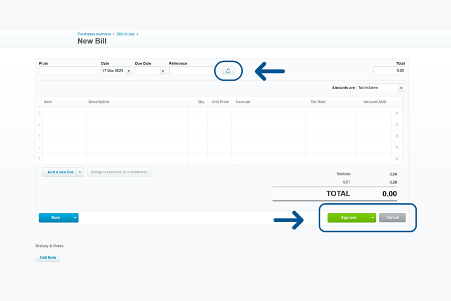

When You Receive Your Coach’s Invoice

- From the top menu, click ‘Business’, then click ‘Bills to Pay’.

- Click ‘New Bill’, then fill out the invoice details. You’ll need to create a new contact for your coach.

- Upload the invoice document to Xero by clicking the page icon next to the ‘Reference’ field.

- When you’ve completed the bill, click ‘Approve’.

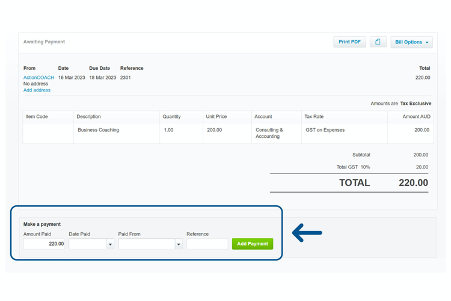

When You’ve Paid Your Coach’s Invoice

- From the top menu, click ‘Business’, then click ‘Bills to Pay’.

- Click on your coaching bill.

- From the top menu, click ‘Accounting’, then click ‘Bank Accounts’.

- You should see your linked bank account; click ‘Reconcile Items’.

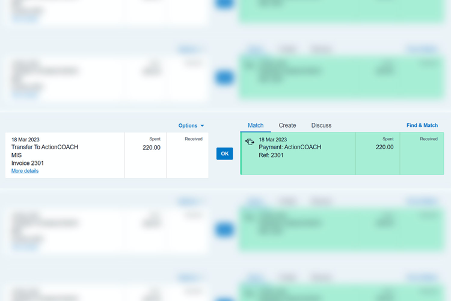

- Find the payment transaction in your feed. Xero should automatically match it with the bill you created previously.

- Click ‘OK’.

Affordable Alternatives to One-on-One Coaching

Even though business coaching is normally tax-deductible, not every small business owner has enough cash to spend several hundred dollars per week on a coach. It’s a hard position to be in – knowing you need expert help to grow, but not having the resources to hire the right people.

If that’s how you’re currently feeling, don’t write off your situation as something that will fix itself. The markets are littered with small businesses and startups that became zombie businesses – just scraping by for years or months on end – until a competitor or market change killed them off for good.

To survive, you need to change – and fast. The sooner you take action, the sooner you can move into the next stage of growth. There are plenty of free business coaching sessions and courses available across Australia, which are ideal for solopreneurs who want to learn how business works.

If you’re a business owner who’s hired a full-time equivalent, though, you’ll probably need something more tactical than a lesson on profit margins. That’s when subscription coaching programs like ActionMEMBERSHIP can be ideal. They’re typically more affordable than one-on-one coaching sessions, and you’ll get the opportunity to network with other entrepreneurs (perfect for B2B businesses).

As a Premium ActionMEMBER, for example, you’ll get access to:

- a comprehensive digital learning library;

- tactical training videos;

- a half-day business diagnostic and strategy session each month;

- a full day of 90-day planning and business feedback each quarter;

- a free book of the month;

- KPI benchmarks; and

- access to ActionCOACH’s annual BizX event.

You can check if business coaching is actually benefitting your bottom line by calculating the ROI.

The takeaway: improving your business doesn’t have to be expensive. Even if you’re cash-poor, you still have options.

Summary

Business coaching is normally tax-deductible, making it a good way to invest in the future of your company. Provided your coach gives you business advice (versus self-improvement advice), you’ll be able to write off the cost and save on your tax return. Always remember to check with your accountant before making any tax decisions.

Not enough cash flow for one-on-one coaching? There are plenty of ways you can still improve your business – look to free coaching workshops or, for more practical advice, subscription coaching services like ActionMEMBERSHIP. Click here to book a discovery session.