A franchise disclosure document gives you the information you need to make a decision about becoming a franchisee. It’s provided by the franchisor, who has strict legal obligations to prepare it in a specific way.

In this article, we’ll explore what disclosure documents are, when they’re required, what’s in them, and the red flags that you should look out for.

Use the table of contents to quickly jump between sections.

What Is a Franchise Disclosure Document?

In Australia, a franchise disclosure document is a legal document that franchise operators (franchisors) must give to prospective franchisees. It gives people thinking about buying a franchise all the information they need to make an informed decision.

As per annexure 1 of the Competition and Consumer (Industry Codes—Franchising) Regulation 2014 (Cth), a franchise disclosure document must contain certain information laid out in a certain way. You can use it to learn about relevant costs and payments, how other franchisees have performed, what your obligations and rights are, and other important details.

Keep in mind that the layout of a franchise disclosure document is fixed by law. If your franchisor doesn’t include the right information in the right way, your franchise agreement might not be valid and they could be liable for civil penalties.

When Are Franchise Disclosure Documents Required?

Your franchisor must give you a franchise disclosure document (along with other legal documents like your franchise agreement and key facts sheet) at least 14 days before:

- you enter into a franchise agreement with them; or

- you make a non-refundable payment to the franchisor or one of their associates in relation to the agreement.

The document you receive must comply with the layout required by the Franchising Code of Conduct – get a lawyer’s help to check it. If it isn’t compliant or if you want more information, don’t be afraid to ask your franchisor questions.

Once you become a franchisee, you’re entitled to an updated disclosure document every year. The document should reflect the franchise’s status at the end of the most recent financial year and can be a good way to check on the overall health of your investment. As such, it’s a good idea to ask for your updated document just after EOFY – that way, you’re getting the most recent information. For Australian-based franchises, EOFY is normally June 30, so think about asking for your document in July.

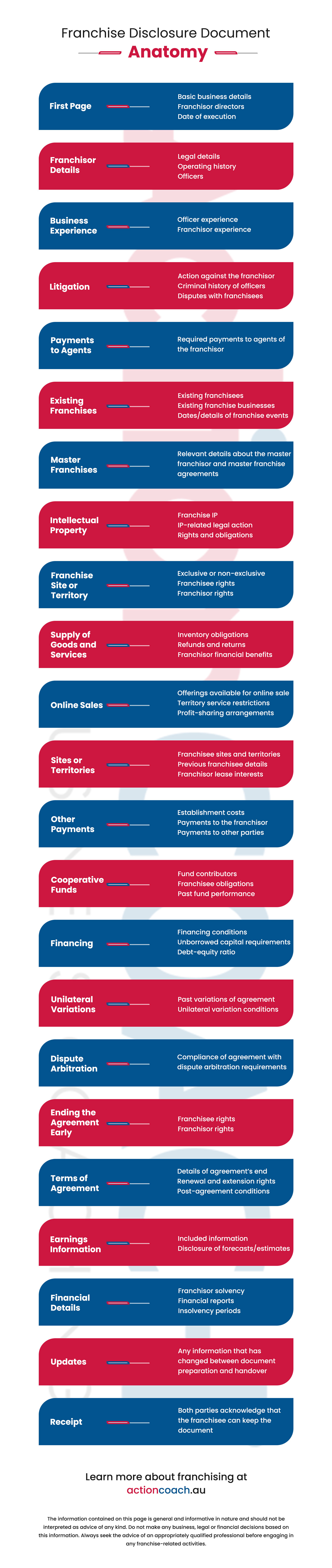

Anatomy of a Franchise Disclosure Document

Franchise disclosure documents have a very specific layout that they need to follow. You can find the exact layout and required inclusions in annexure 1 of the Competition and Consumer (Industry Codes—Franchising) Regulation 2014 (Cth). For a plain English explanation, take a look at the ACCC’s guidance template.

Here’s a visual guide to roughly what your franchise document should include.

What to Look for in a Franchise Disclosure Document

When you’re looking through your franchise disclosure document, keep an eye out for two main types of information: details that affect your franchise’s business viability and franchisor red flags.

The best way to check business viability is to compare the details of the disclosure document against your business plan. For example, if you were thinking about buying a skincare franchise and you wanted to rely on e-commerce as a source of revenue, not being able to sell franchise products online could be a big problem.

Spot an issue with viability? See if you can adjust your business plan or negotiate with your franchisor.

Red flags are more problematic than viability concerns. If you identify an issue with the fairness of the agreement or the trustworthiness of the franchisor, talk to your lawyer about whether going ahead with your purchase is a good idea. Some ‘franchises’ are actually scams or pyramid schemes, and, even if the franchise is legitimate, too many warning signs can mean that you and your franchisor won’t be a good fit.

Common red flags include:

- The franchisor has had a high number of disputes with other franchisees.

- The franchisor or its directors have been bankrupt or have been in legal trouble.

- You can’t easily contact former franchisees.

- Your franchise disclosure document is incorrectly structured or missing information.

- You can’t work out how much your business will cost to set up.

- The franchisor won’t provide you with a site/territory history.

- You can be terminated as a franchisee over minor matters.

- Pre-purchase or post-agreement costs are unclear.

- Earnings information seems inaccurate or irrelevant to you.

You can read more about what to look for in franchise disclosure documents here.

How to Get Franchise Information Before Receiving a Disclosure Document

You don’t need to wait until the franchisor hands over a disclosure document to get the facts about their business. The Franchise Disclosure Register is an Australian federal register that contains disclosure statements for all franchises in Australia. If a franchisor isn’t registered, they aren’t compliant with the Franchising Code of Conduct.

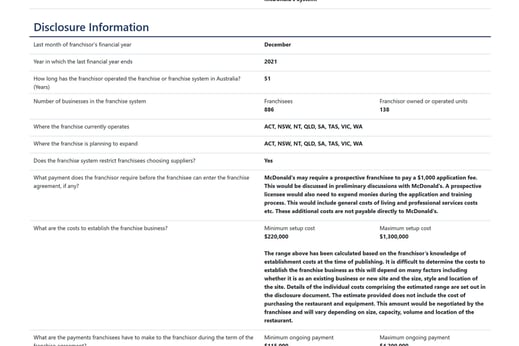

Each register listing features franchisor details, such as trading name, ABN, and industry, as well as disclosure information, such as establishment costs and ongoing fees. Use the register to get a sense of how much your franchise could potentially cost (as well as whether there are conditions like restraints of trade or supplier restrictions).

A screenshot of McDonald’s register listing.

Next Steps

A franchise disclosure document is one of the three main legal documents you need to understand if you’re thinking about buying a franchise. In many ways, it’s your source of truth – regardless of what promises or comments the franchisor has made in the past, everything you need to know should be contained in the disclosure document.

Franchise disclosure documents can be complex, so it’s definitely worth paying an experienced commercial solicitor to go over your document with you. If information is missing or you spot red flags, ask the franchisor to explain. A franchise is an expensive commitment that can be very hard to get out of it, which is why it’s important to check all the details before you sign.

As a franchisee, you have the chance to build your own business with an experienced partner – and doing your due diligence means you can both enjoy a healthy, successful relationship.

The information contained on this page is general and informative in nature and should not be interpreted as advice of any kind. Do not make any business, legal or financial decisions based on this information. Always seek the advice of an appropriately qualified professional before engaging in any franchise-related activities. .

.

April 20, 2023